FRASERS HOSPITALITY TRUST ANNUAL REPORT 2015

183

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL PERIOD FROM 20 JUNE 2014 (DATE OF CONSTITUTION) TO 30 SEPTEMBER 2015

26.

FINANCIAL RISK MANAGEMENT (CONT’D)

(d)

Liquidity risk (cont’d)

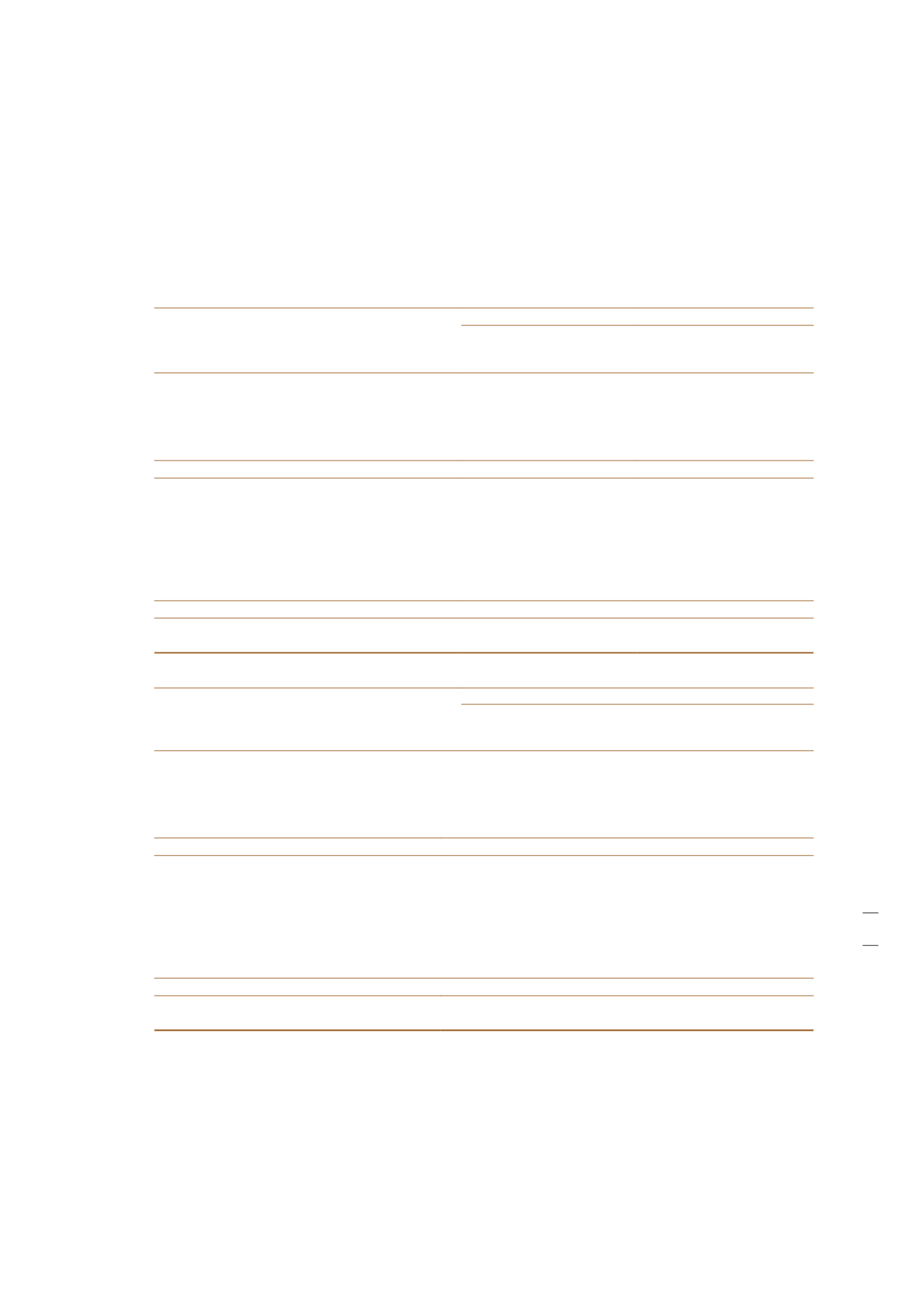

The table below summarises the maturity profile of the Stapled Group’s significant financial assets and

liabilities at the reporting date based on contractual undiscounted repayment obligations:

FHT

Within one

year

Between one

and five years

More than

five years

Total

At 30 Sep 2015

$’000

$’000

$’000

$’000

Financial assets

Cash and cash equivalents (Note 14)

52,308

–

– 52,308

Trade and other receivables (Note 13)

5,973

–

–

5,973

Derivative financial instruments (Note 18)

196

8,631

–

8,827

58,477

8,631

– 67,108

Financial liabilities

Trade and other payables (Note 15)

(12,723)

–

– (12,723)

Derivative financial instruments (Note 18)

(484)

–

–

(484)

Borrowings (gross) (Note 17)

– (790,620)

– (790,620)

Interest payable on borrowings

(18,788)

(44,423)

– (63,211)

Rental deposits

–

– (17,099)

(17,099)

(31,995)

(835,043)

(17,099)

(884,137)

Net undiscounted financial assets/

(liabilities)

26,482 (826,412)

(17,099)

(817,029)

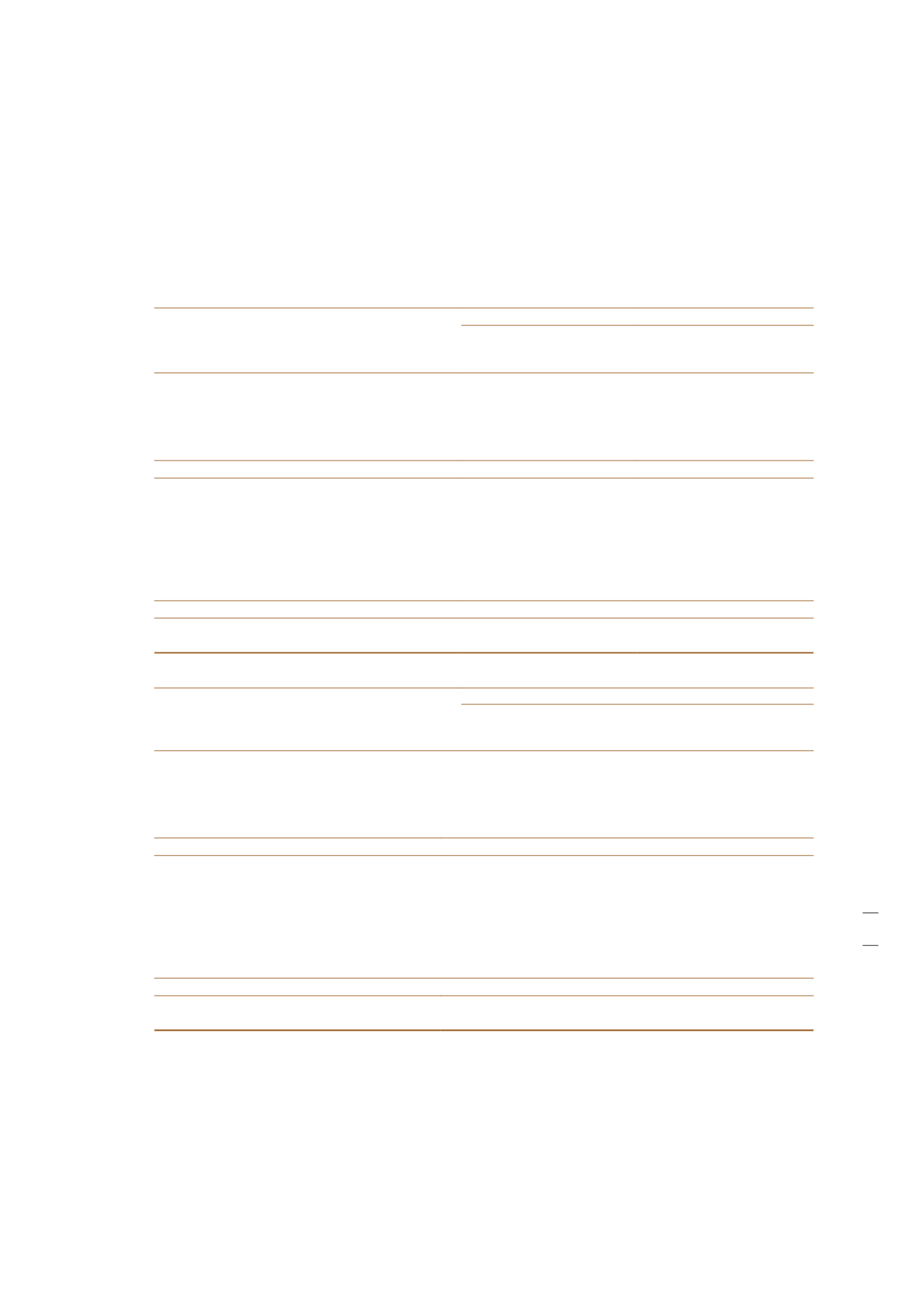

FH-REIT Group

Within one

year

Between one

and five years

More than

five years

Total

At 30 Sep 2015

$’000

$’000

$’000

$’000

Financial assets

Cash and cash equivalents (Note 14)

52,298

–

– 52,298

Trade and other receivables (Note 13)

5,973

–

–

5,973

Derivative financial instruments (Note 18)

196

8,631

–

8,827

58,467

8,631

– 67,098

Financial liabilities

Trade and other payables (Note 15)

(12,721)

–

– (12,721)

Derivative financial instruments (Note 18)

(484)

–

–

(484)

Borrowings (gross) (Note 17)

– (790,620)

– (790,620)

Interest payable on borrowings

(18,788)

(44,423)

– (63,211)

Rental deposits

–

– (17,099)

(17,099)

(31,993)

(835,043)

(17,099)

(884,135)

Net undiscounted financial assets/

(liabilities)

26,474 (826,412)

(17,099)

(817,037)